Cryptocurrencies and decentralised applications will give way to the world’s first pure free market economy.

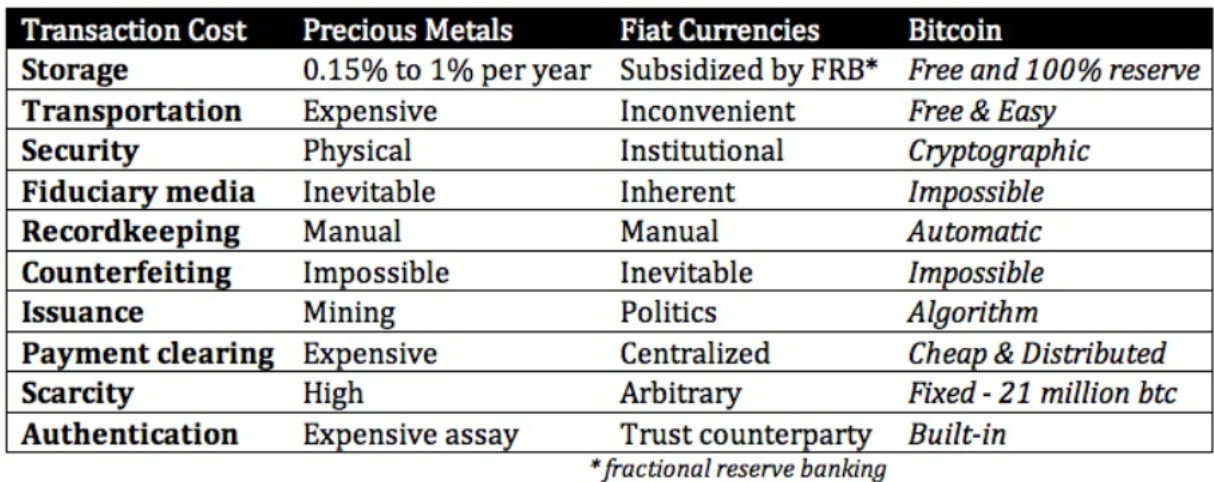

Cryptocurrencies have gained rapid traction as an accepted medium of exchange, and while the ownership and use of cryptocurrencies may be a result of speculation, their adoption will increasingly depend on their respective attributes and utility.

The current economy of cryptocurrency usage comprises of two main areas of growing attention: peer to trading in the form of money and the use of uniquely propositioned applications that function using cryptocurrency (decentralised applications). Enabled by a symphony of distributed computing, cryptography and incentive design, these technologies have drive promise and adoption in light of their digitally uncensorable properties. And while cryptocurrencies are currently still in its infant stage, they have nonetheless, produced such a set of consumers and firms which are willing to accept it as a medium of exchange for goods and services (the defining behavior of what constitutes the concept of ‘money’).

Driven by efficiencies as a medium of exchange and their rising utility provided by decentralised applications, there will be a point in time where consumers will begin to adopt, own and use cryptocurrency. As the market continues to grow, firms will have a business case to pursue the adoption and use of such technology. This adoption amongst firms, especially consumer facing vendors, will add to the network effect, driving greater consumer and household awareness, eventually leading to an adoption of cryptocurrency at scale.

Unlike the traditional fiat economy, the cryptoeconomy is inherently global as its constituents do not belong under any specific governmental jurisdiction, and nor can it. Governments exist to provide public goods, enforce common laws and aim to provide a framework for society to exist in a productive state. An example of how the governments power is in how they are financed. They are financed by the individuals and firms of the economy through taxation as a primary means of funding public goods and regulations but also the enforcement of the government’s own laws. Laws and regulations are enforced through legal (eg. court orders with social and financial consequences), physical (eg. physical arrest and detainment) and financial sanctions (eg. fines, penalties). These means are enabled through mass monitoring and surveillance of the various valves lined across the economic chain of value. Governments exist as a consequence of economies and have such high degrees of control due to their level of control and visibility over the economy.

However, with the case of the cryptoeconomy which are mostly powered by p2p technologies (eg. blockchains, DAGs) with no central point of control and failure, the weight of the central government’s legal, financial and physical enforcement of each respective nation’s laws and regulations have little effect on a digitally resilient economy that exists outside the reach of traditional powers. Future applications of privacy enabling developments to either, protocol level or layer two infrastructure, and as a result, heavily sever the government’s visibility on such an economy and their core strength in the regulation of the fiat economy.

Naturally, through the global rise of an economy for which governmental authorities have little power over, such jurisdictions around the world will decrease in its ability to govern its own nations financially, economically and socially, reducing its involvement only to traditional fiat matters. This is unless central authorities attempt to either enforce regulation on cryptocurrencies which through historical precedents of cryptography and torrenting, harsh enforcement of any technology is a futile effort.

And such a scenario begs the question of how public goods are provided and how such decentralised technologies (eg. Bitcoin, Ethereum...) will be governed, especially with the weight of a global economy established of such technologies. While the path in the government’s erosion of power is unclear, it will manifest itself naturally as the world moves towards an unstoppable digital economy.

Ps. Thanks to terado technologies for helping edit this