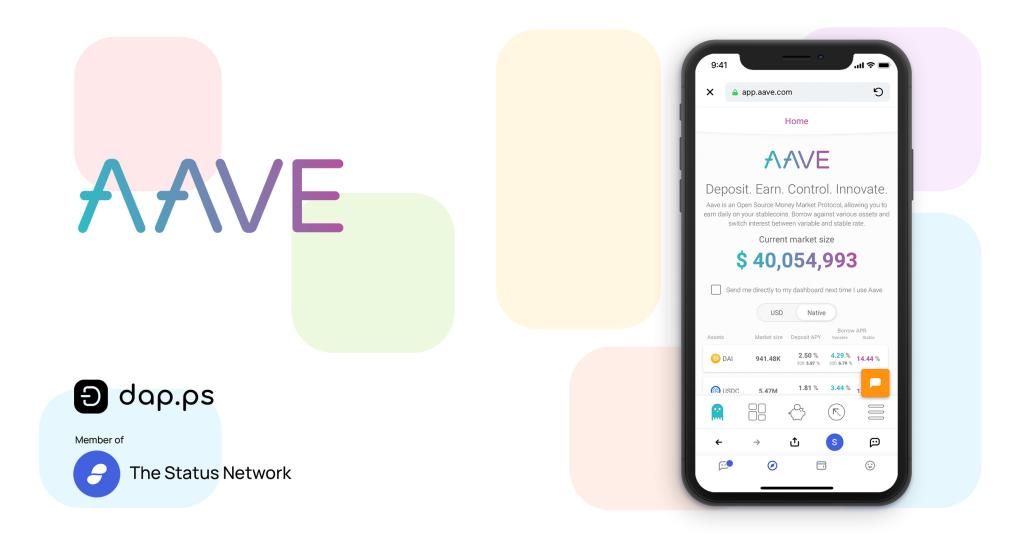

It's always fantastic to see options growing in an emerging market. It's competition, collaboration, and expanding an industry where there is appetite for new products. Aave is a prime example of this in the open lending DeFi space. Aave brings a compelling interface and competitive option for depositing crypto and earning interest, or borrowing against crypto collateral.

It's fantastic to see how easy and clean the Aave user experience is right through the Status mobile app, but it's also an incredible example of how the DeFi space is growing and getting stronger.

There's a buzzword that I like. It sounds awful and like a load of business-speak, but at its core, it's a really good term that means something important. Ready?

Robust ecosystem.

I know I know, it sounds like a marketing person trying too hard. But here's the thing, robust ecosystems are critically important in society, government, ecology, computing, finance, and in DeFi.

Robust: Healthy, strong, holds up against threats. A robust statistical model can provide quality results with a lot of weird data. A robust person is in good health and can fight off sickness and injury.

Ecosystem: A community of interacting agents, an interconnected system. An ecosystem has many elements that work in a complex (often unpredictable) way to create a system that maintains itself.

For DeFi to create long-term value, it needs to become a robust ecosystem. We want our financial systems to be robust ecosystems. We want financials to be strong and maintain consistency to a reasonable degree, but to do that there needs to be more than one or two institutions (even decentralized institutions) to help maintain the overall health of DeFi.

Aave is another mission-driven option for earning interest and borrowing in an open lending pool. As they say, “Decentralized Finance doesn’t require your ID, doesn’t need you to fill paperwork, and doesn’t slash your earnings to a herd of middlemen”. They have 17 different assets, 6 of which are stable coins, available for depositing and borrowing, and the Aave interface addresses the quirky DeFi user experiences to make DeFi feel more polished and ready for the mainstream.

More options in DeFi gives more competition as well. Aave has some pretty compelling products like Aave Interest-bearing tokens aka “aTokens”, which accrue interest in real-time directly your wallet. Borrowers can switch between stable and variable interest rates to get the best rate available, and developers can work with undercollateralized flash loans. More products for borrowers enable depositors to earn more back on their funds. With more product options, there are more fee options. In DeFi the users gain the rewards of these added services rather than the banks.

At Status, we love seeing more of these options becoming available for mobile. Aave is staked on dap.ps, which the Status mobile app uses as our web3 browser. This means that DeFi is growing by hardware access as well as by platform and investment growth.

Check out Aave's lending rates and see how clean it is through the Status mobile app. Chat, browse dapps, transact, and swap all from your phone through the secure Status app. Install and check out the Status App, and also join in the dap.ps chat channel #dap-ps.

Check out these DeFi Dapps dap.ps >>

*Disclaimer - This article was written for your entertainment, and the content is for informational purposes only. You should not construe any such information or other material as investment, financial, or other advice. Using decentralized financial tools does not come without risks and using Status is simply a portal to these tools - Status does not mitigate associated risks of said products.