The Compound protocol is the first algorithmic money market, allowing users to easily earn interest by lending out DAI and other Ethereum-based funds.

Compound is not a bank. They never hold your funds, they never manage your funds. However, DeFi gives us some amazing options with the way that we control our own funds, loan them out, or borrow more. Compound is a platform that enables this to be an intuitive experience while we generate excellent interest on our funds.

The Ethereum DeFi architecture enables advanced financial exposure while maintaining control of your own funds without a middleman, order book, or counterparty. For the majority of users, this means earning a high interest rate, or using crypto as collateral to borrow stable coins.

At a traditional bank, customers deposit money, and the bank manages those funds to generate a return on the interest charged to the borrower. Banks typically make the largest portion of their revenue on lending. In the centralized banking model, the customer gives the bank funds, the bank lends out the funds, collects the interest, takes their cut, and pays interest (minus bank costs & revenue) back out to the original customer.

What if you could use smart contracts instead of a bank? What of you could let the middle portion of this lending process be run by machines that take fractions of a cut instead of large revenues that banks take?

This is the idea behind Compound, and like other DeFi lending platforms, they create open lending and borrowing so users can skip the bank middleman, still retain a relatively low risk of losing their funds, and create a stable base for their own DeFi investment portfolios.

How much can someone earn with DeFi open lending? European averages are around 0.88%, U.S. averages generously around 1.15%, and the other regions are a bit worse or follow suit.

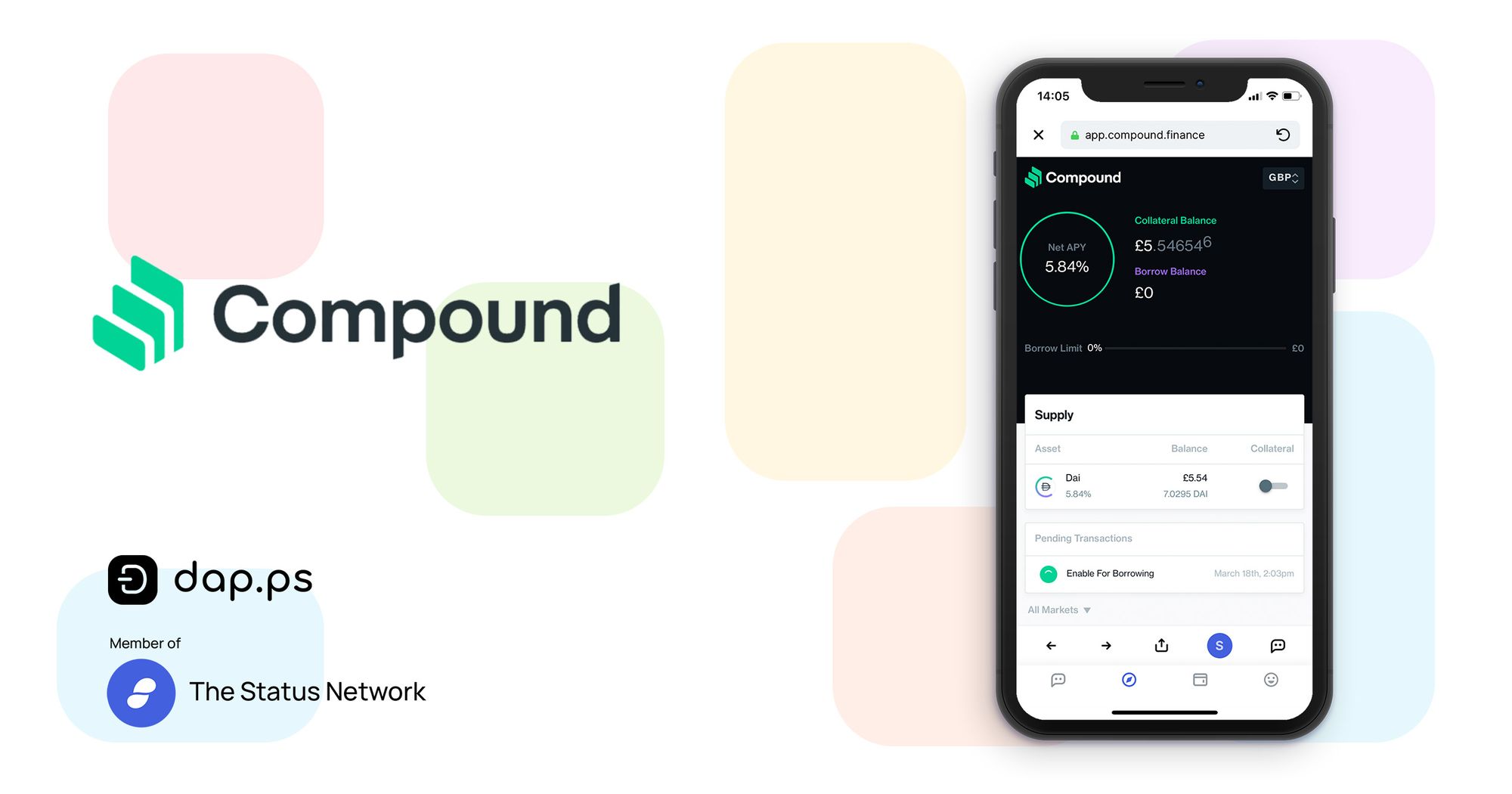

At time of writing, Compound is at 5.09% (and this is being written after the COVID-19 crashes of mid-March), although rates fluctuate between 4% and 9% regularly.

Compound is one of the most boring/exciting dapps you can get access to on the mobile Status app. It's exciting because the rates and control of the funds are nothing short of revolutionary for finance. But it's boring because it's just a savings account! But a savings account the way it could be (and is!).

Compound is yet another partner in dap.ps available through the Status mobile app. Mobile DeFi portfolios are available here and now. To see how Compound runs on mobile, get the Status App and join in the #dap-ps chat channel to talk with us about the incredible variety of dapps available on mobile.

Install Status >>

Check out these DeFi Dapps dap.ps >>

*Disclaimer - This article was written for your entertainment, and the content is for informational purposes only. You should not construe any such information or other material as investment, financial, or other advice. Using decentralized financial tools does not come without risks and using Status is simply a portal to these tools - Status does not mitigate associated risks of said products.