You may notice that conversation about DeFi on crypto blogs and Twitter often uses the term money legos. The DeFi community is especially excited about this idea as it exemplifies one of the leading Ethereum memes programmable money.

But what do money legos and programmable money mean for the average person? We thought we'd break down what these terms mean so you can decide if you want to start building your finances with money legos for yourself.

The key concept around money legos is composability. Composability generally means that stuff is built to work together in a variety of ways. A car is NOT composable. You can't pull out the engine and install it where the transmission goes, or install an air filter to do the job of the brakes. The components of a car are highly specialized and ordered to make a finely tuned machine. A car is limited by physics, chemistry, and other disappointing realities of...well...reality.

Programming, however, is a lot different than a car. A computer program runs in the order it's told to, and is pretty much only limited by the rules of the system. An example of composability in action is in video games. It's one reason why games can be so engaging. In our example game, the player can command their character to run, jump, attack, blow bubbles, go fishing, or whatever the system allows in practically any order the player wishes. Game mechanics as described here are composable.

Composable programming extends to DeFi as well. In a smart contract a programmer can make an action happen before, after, if, parallel to (and/or other commands) another action, or many more actions together or ordered how the program allows. A good programmer can rearrange the order and specify a clear pattern of events with programming logic.

With DeFi, composability becomes an extremely interesting programming puzzle. Because so many of the DeFi projects are composable relying on the base layer of the blockchain, then you can make some interesting patterns of events. For example, I could:

- Take out a loan of DAI on Compound

- Split that DAI into two even amounts

- Put one half into Oasis and generate 8% interest

- Put one half into a leveraged position for ETH on DeFi Zap

- Pull out the funds from both at a given price level of ETH

- Repay the loan and interest back to Compound

- Keep the remaining balance earned from the leveraged position (assuming ETH price went up)

The above example could all be done in one smart contract, so it's set up to follow the preset commands given by the programmer. Composability means that these steps can be reordered, added to, or removed in the smart contract, so as financial programmers find market opportunities, they will use programming to find opportunities to make money.

The term money legos references this exact phenomenon. A good lego builder can take the pieces from a castle set and rebuild it into a completely different object. Money legos in DeFi allow dapps to work together with the common base layer of the blockchain.

DeFi is an exciting new field for programmable money and finance. We're only now learning how to build, secure, and refine the systems that are being built, so there is definitely risk involved in these systems. This is a new way to work with money, and we're in early days of experimentation for some incredible potential outcomes.

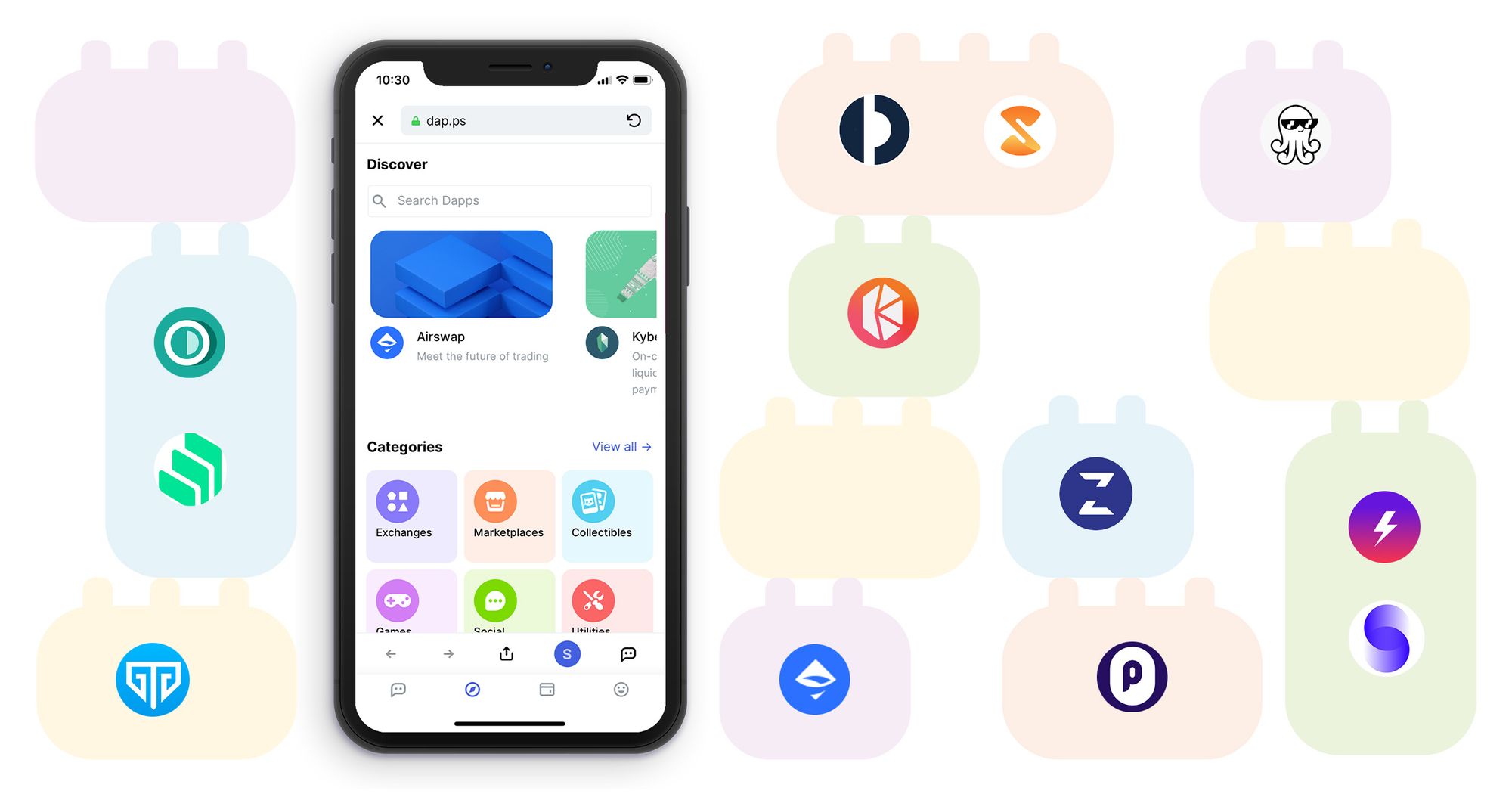

The goal of DeFi is to build robust systems for people to be able to choose the financial systems that give them the most financial freedom. Status is passionate about providing social financial tools to give people the access they need for DeFi. The Status App works with numerous DeFi projects in order to create a mobile option for people to choose DeFi and cryptocurrencies if it fits their needs. Take a look at the Status App now, and see mobile DeFi money legos for yourself.

Check out these DeFi Dapps dap.ps >>

*Disclaimer - This article was written for your entertainment, and the content is for informational purposes only. You should not construe any such information or other material as investment, financial, or other advice. Using decentralized financial tools does not come without risks and using Status is simply a portal to these tools - Status does not mitigate associated risks of said products.